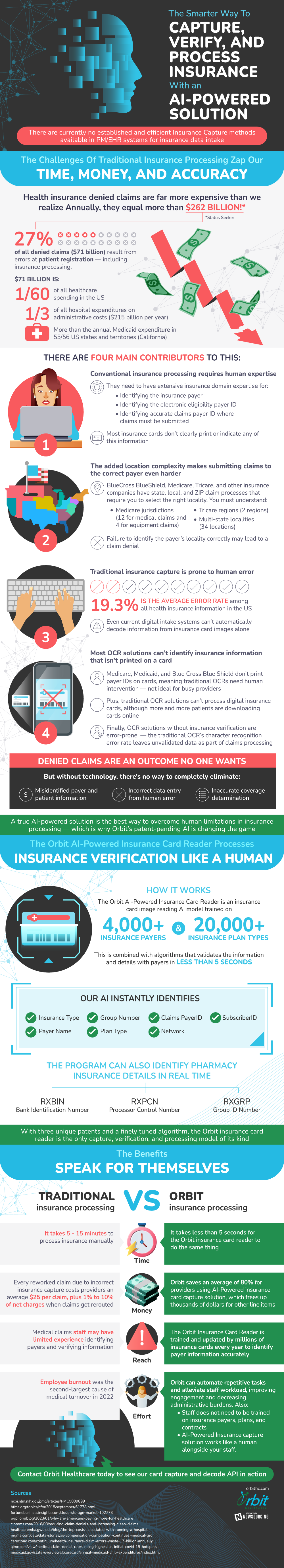

Insurance companies everywhere are in search of a better way to capture, verify, and process insurance. The current methods are inefficient and can be inaccurate, fueled by human intervention and limited functionality. Denied claims are costly, totaling to billions annually, as the need for change becomes more pressing.

Among issues of location and software limitations, the main issues with insurance processing today is the need for human intervention. Conventional insurance capture currently requires human expertise, meaning that training and knowledge must be an acquired skill. When humans are needed to step in for manual forms of processing, the chance for error increases. In fact, the current average error rate among all health insurance information in the United States is 19.3%. These costly mistakes, in combination with other limitations of traditional methods, further emphasize the need for advancement.

Experts agree that an AI-powered form of insurance processing and verification is the answer to our current problems. This technology has the power to be faster, more accurate, and more capable than any human has the potential to be. What traditional insurance processing could do in a matter of minutes, artificial intelligence can do in a matter of seconds, and with more success. Able to instantly identify important pieces of information needed to process plans, the limitations are lifted with AI-powered health insurance card capture tools.

Source: OrbitHC